Accounts receivable (or invoice financing) is a type of capital funding that helps companies receive early payment on their outstanding accounts receivable.

[ez-toc]

What is Accounts Receivable Financing?

Accounts receivable financing (or AR financing) allows businesses quick access to working capital by keeping their unpaid invoices as collateral to a funding company. It is widely used by firms with larger accounts receivable and requires cash to fund their business expenses.

This financing is usually short-term, allowing borrowers to utilize their accounts receivables as collateral to receive funds from the lenders.

The receivable financing companies pay out a portion of the company’s accounts receivable total face value. Notably, the portion of the outstanding invoices depends on the receivables’ quality, customer potential, and other factors.

In accounts receivable financing, the borrower remains the owner of the receivables and is responsible for collecting the customers’ invoice amount.

Why Should Small Businesses Consider Accounts Receivable Financing?

Small businesses often experience financial pressure that hinders their growth and success. One of the difficulties that small organizations face is managing their cash flow.

AR financing could be an effective solution, in this case, aiding businesses in overcoming capital issues. It allows businesses to convert their receivables into cash. So, small businesses can receive immediate capital by selling their invoices without waiting for their customers to pay.

This loan method could benefit small businesses operating in longer payment cycle sectors, like construction, manufacturing, etc.

Slow sales or soaring expenses can cause a cash flow issue for a small business. But, they can opt for accounts receivable financing for paying their bills, buying inventory, and other investments.

Businesses with a record of late payments or unpaid invoices need help to secure traditional forms of loans or funding. But accounts receivable financing depends on the credit score of the business’s customers, not the business.

Example

Let’s look at the example below to understand the concept better.

Example: ABC Inc. produces construction or manufacturing-related products, and DEF Inc. is its client. DEF Inc. is a big company that follows a long payment cycle of 90 days.

So ABC Inc. will have to wait 90 days to receive the payments for their products sold. This can cause a cash flow issue for the company, as it will have to maintain its operating costs like labor payments, buying raw materials, etc., in this due time.

But with accounts receivable financing, company ABC Inc. could approach a financier (generally a factoring company) and use their unpaid invoices to receive payments. After receiving the money from DEF Inc., ABC Inc. can return the loan amount to the AR loan provider. The lender will make the payment immediately to help continue the manufacturer’s business.

Types of Accounts Receivable Financing

AR financial could be of different types, which are-

- Factoring accounts receivable financing:В This concept allows businesses to sell their outstanding invoices to an organization (factoring company) at a discounted rate. The discount in the factoring concept generally depends on the quality of receivables.

The factoring company becomes responsible for collecting customer payments as outright sales are implemented in this process. After the customer pays out, the factoring company pays out the remaining balance to the business that has sold the unpaid invoices in the first place after deducting a fee. - Accounts Receivable Loans: These are a form of short-term funding. The AR loans allow many businesses to use their accounts receivable as collateral to avail of loans from accounts receivable financing companies. Once the loan gets sanctioned, the financier pays a portion of the receivable’s face value as loans to the borrowing party. Unlike the invoice factoring concept, the borrowing party will be responsible for the assets while remaining the owner. So, the borrowing organization will have to collect the unpaid invoices from its customers and repay the loan to the financing firm with interest.

- Asset-backed Securities: are a fixed-income channel collateralized by an underlying pool of assets. The financial concept allows businesses to generate cash flow from debt like loans, accounts receivables, etc. These issuing securities, created by pooling the outstanding invoices, are backed by them. It is like bonds or notes that pay at a fixed rate for a set amount of time until maturity. Thus, the issuer of the securities can monetize their accounts receivable without selling them outright.

How Accounts Receivable Financing Work?

When a business opts for accounts receivable financing, it contacts an AR financier. The company requesting funds submits its outstanding invoices to the financer, which checks the validity of the invoices’ documents and the creditworthiness of the customers who owe the money to the company.

Once the invoices are approved, the financing firm provides a portion of the invoices’ value to the borrowing party. The portion amount depends on the financing agreement terms between the two entities.

Importance of Invoice Factoring in this Case

Invoice factoring is similar to accounts receivable financing, allowing businesses to convert their outstanding invoices into cash. It is used by companies facing challenges in getting traditional loans but need to improve their cash flow immediately.

The borrowing party could sell their unpaid invoices to a third-party (factoring institution) at a discounted rate. In return, the financing organization pays out a portion of the total face value of the invoices, depending on the quality of accounts receivable.

The remaining amount is generally kept in reserve and is paid to the borrowing party once the customers wholly pay the invoices.

Difference between Accounts Receivable Financing and Invoice Factoring

Although accounts receivable financing and invoice factoring are often used interchangeably, some key differences separate them. The main differences between the two concepts are-

| Basis of Difference | Accounts Receivable Financing | Invoice Factoring |

| Financing Type | Loan depends on a business’s accounts receivable and allows businesses to borrow cash against their accounts receivable as collateral, generally used to cover immediate cash flow requirements for a short term. | It enables companies to sell their accounts receivable to a factoring company, a third party. The factoring company then provides the borrower with a part of the outstanding invoices’ total face value. The remaining balance is paid once the customers fully pay the invoices. |

| Control Over the Assets | Allows businesses to retain control over their accounts receivable. Businesses are responsible for collecting payments for unpaid invoices from customers in this process. | Businesses have no liability in collecting customer payments as the accounts receivable are sold to the factoring company. |

| Cost Or Expense | It incorporates interest charges, fees, etc., that could be added over time. | It involves a discount fee, a portion or percentage of the invoices’ total face value charged by the factoring firm. |

| Credit Score | It is a loan that can positively or negatively impact a business’s credit score, depending if the receivable loans are repaid on time. | It is not a loan; hence, it doesn’t directly impact the business’s credit score. However, the business’s credit score might be impacted in specific cases. |

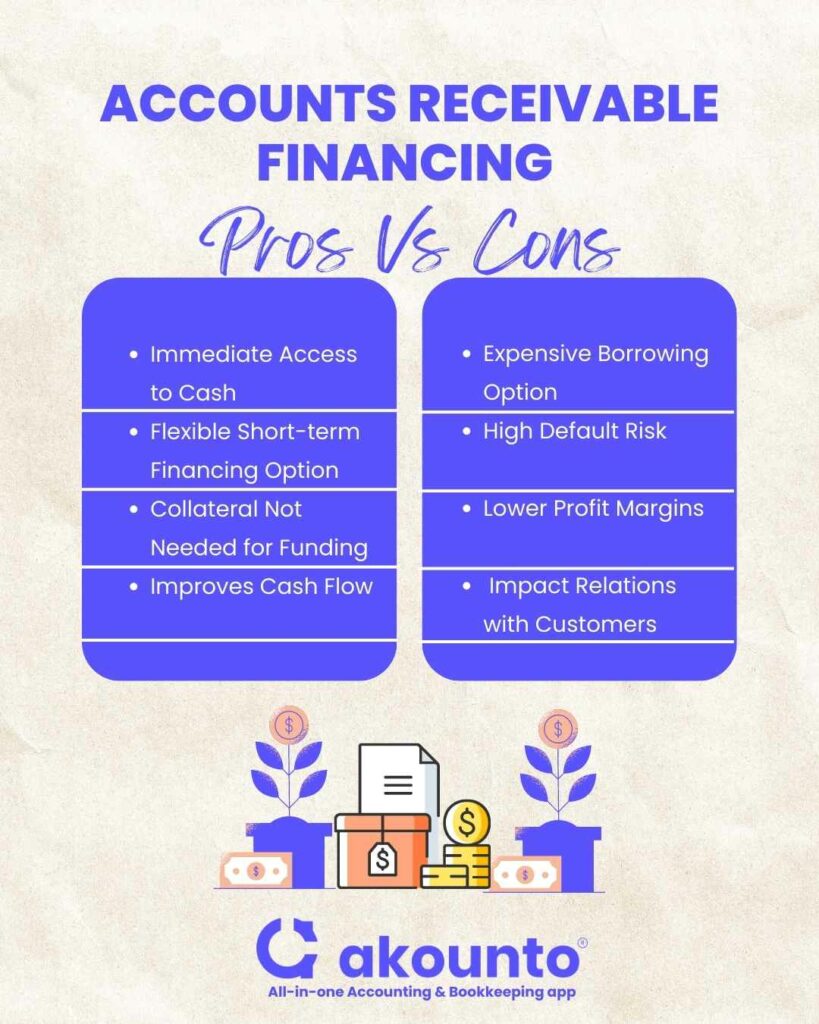

What are the Pros and Cons of Accounts Receivable Financing?

Accounts receivable financing is a great concept for businesses struggling with cash flow. But it also has some downsides that businesses should consider before opting for it.

Final Words

Accounts receivable financing is a useful concept that helps improve any business’s cash flow. Businesses with poor or bad credit often need help to get loans from banks or financial institutions. Besides, it also helps them manage their working capital more efficiently.

But a company should check if it has potential and creditworthy customers before opting for AR loans. Otherwise, a business could face hurdles to repaying the loan if the customer fails or delays paying.

So, it is recommended to do thorough research and consult a financial advisor to determine if accounts receivable financing is the right option for you.

VisitВ our blog to read more finance-related information and articles.