What are Billable hours?

Billable hours refer to the time spent on work tasks for a client who is bound to compensate or pay according to the agreed-upon payment terms.

In this case, the distinction between billable and non-billable hours must be very clear. To charge the client for the billable hours you spend on the task, keeping track of them is important. Consultations such as legal services, freelance service providers, small businesses, and agencies record their billable time based on the total hours spent directly on the client’s tasks.

[ez-toc]

The concept of billable hours is a familiar one. The traditional mode of payment calculation has always been task-based, meaning that a person gets paid for the jobs they perform and not for the number of billable hours he spends doing them.

Billable hours are more common among legal professionals who bill clients for legal services directly related to them. The legal profession, however, has faced a lot of criticism, mainly because the number of billable hours does not ensure or record the quality of the task completed.

Billable vs. Nonbillable Tasks

The hours spent directly on the client’s project will be considered billable. While the tasks related to the organization that may help bring or maintain clients but do not link directly to the client’s project are considered non-billable.

The distinction between billable and non-billable tasks needs to be clarified and well-defined. How many billable hours a person spends on a certain task depends on the nature of the business, organization, task, and agreement with the client. By and large, billable hours spent on a client’s project will constitute the following tasks:

- Any task that helps complete the project.

- Attending meetings with the client directly related to the assigned project.

- Responding to the work emails.

- Reviewing and revising the work submitted.

- Project planning, such as creating a timeline for the client.

For small business owners and freelancers, some tasks cannot be billed to the clients but must be performed to sustain the business.

- Creating proposals for winning new clients

- Pitching new work to the active clients

- Joining the company’s training sessions

- Brainstorming meetings

- Networking and team-building events

- Consultations and meetings before signing a contract

- Administrative tasks such as preparing invoices

Is Time Spent Billable or Non-Billable?

To determine whether your time spent on a task is billable or non-billable, you need to follow a simple rule: If you worked for a client-specific job that agrees with you on an hourly basis, your time is billable.

If you worked on a task non-specific to the client, this would be your non-billable time. So, the jobs not directly related to paying clients’ projects, such as client development and office management, do not come in your billable time.

So, basically, yes. Time spent is counted against billable hours, but only when it directly contributes to completing the paying party’s task. For example, if you make a mistake and spend extra hours preparing the client’s project, these hours may only be billable in some cases. In this case, the extra hours will benefit you by helping you provide the already promised service and keep the client.

Similarly, if the client has provided an outline or work brief, and you, as an employee, spend extra hours to provide a complementary service not included in the brief, those hours worked will not be billable. So, the hours worked will be billable if they benefit the client, and those, too, should be according to the contract.

How to Track Billable Hours effectively?

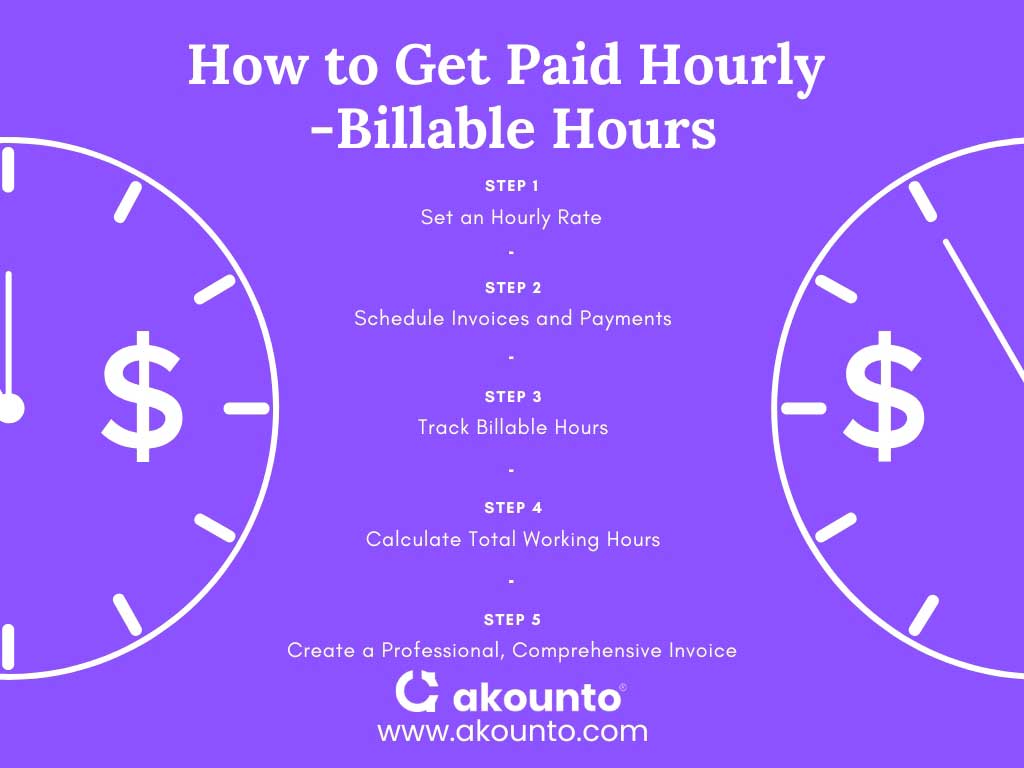

Here is a standard procedure for calculating billable hours for invoicing a client accurately:

Set an Hourly Rate

The first and most important step to calculating billable hours is determining the rate you would like to charge for your billable hours. You can raise it slightly to offset all the administrative tasks, and client-related non-billable time you will be spending. If you are getting an annual or monthly salary, you must divide that by estimating your working hours for the duration.

If you are getting paid hourly, you should know what others in your field and job description are getting paid annually, monthly, or hourly. Having an hourly threshold rate in mind helps keep track of how many billable hours should be built and ensures that your time and experience are valued.

The employer also has to do a lot of due diligence in the case of an hourly-based payment model. As a hirer also, you should research the market rates hourly, monthly, and yearly to avoid discrepancies.

Schedule Invoices and Payments

Invoices and payments should have a predetermined schedule so that there is minimal room for error. Most companies and freelancers prefer a monthly invoice schedule, but weekly and biweekly are also very common and convenient.

Some hiring companies and service providers use tracking software for billable hours, automatically sending invoices according to the schedule. So, a schedule for invoices and payments is even more important in that case. Scheduling also involves determining the payment method.

Track Billable Hours

Tracking billable hours is crucial and may be tricky in some business arrangements. As a service provider or an employer, you may need clarification about which hours are billable and which are non-billable. The initial agreement must contain every detail about time tracking and billable work.

To efficiently track the billable hours, you can do it manually using a spreadsheet. Or you can automate billable hours tracking using any of the software available on the market. Some of these time-tracking software lets you log in and out of your work hours, keeping the numbers authentic for both parties.

Calculate Total Working Hours

The next crucial step in calculating the billable hours is adding up each client’s billing hours separately. Multiply the billable hours with the determined payment rate to prepare invoices by the end of each billing cycle. Tracking software can automate the process, but double-checking always helps.

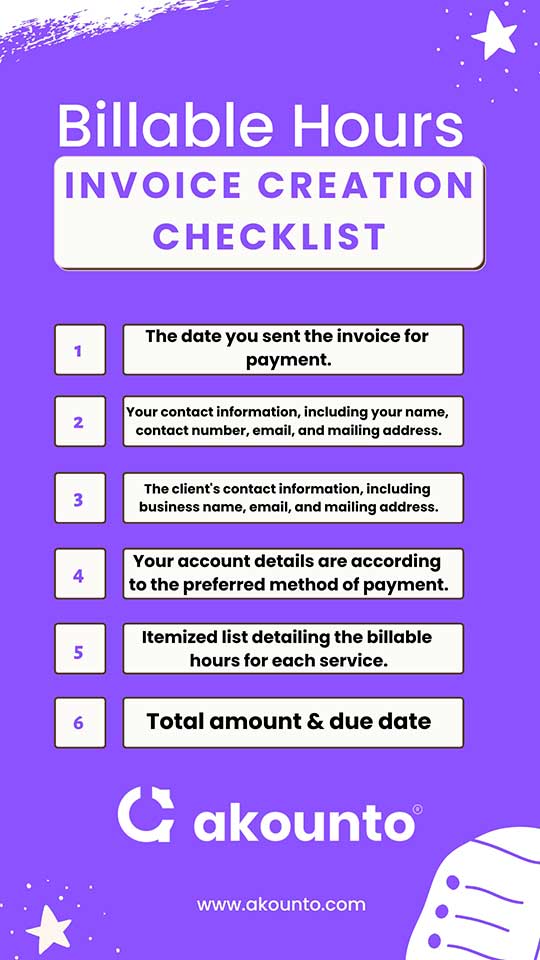

Create a Professional, Comprehensive Invoice

After calculating the billable hours and their payment, you must prepare a comprehensive, detailed invoice for the client. It should carry the following information:

- The date you sent the invoice for payment

- Your contact information, including your name, contact number, email, and mailing address

- The client’s contact information, including business name, email, and mailing address.

- Your account details are according to the preferred method of payment.

- Itemized list detailing the billable hours for each service.

- The total amount to be paid and the due date should be mentioned in the payment terms of an invoice.

How to Get Paid for Non-billable Hours?

Client agreements should clearly state the billable hours and the non-billable ones so that neither gets exploited. There are often inevitable non-billable tasks that the service provider has to handle, which can quickly burden the organization.

Utilization is the total billable hours you can pull out of your employee’s available hours. A staff utilization rate of 85 to 90% counts as a sufficiently profitable one, says research by HubSpot.

How you can charge for your non-billable services is simple: charge your clients enough that it easily compensates for such organizational and management tasks.

Here are some ways you can use to optimize your billable hours and hence compensate for your inevitable non-billable work hours too:

- Identify the specific clients and the type of projects that take more non-billable hours than billable ones. Cut them off or avoid taking unprofitable clients and projects in the future.

- Using practice management software automates your billing and administrative tasks that do not count toward billable hours.

- Ensure efficient time tracking and scheduling to maximize your employees’ work-hour contributions.

- Track every employee’s contribution objectively to see if his work hours are billable or just another name for inefficiency.

What Industries use Hourly Billing?

Hourly billing has effectively tracked a professional or service provider’s payment and working hours. Mostly, private firms and freelance service providers charge clients hourly. Industries that commonly use hourly billing include:

- Law firms

- Private accounting firms

- Consultants

- Advertising agencies

- Contract-based employees

- Individual freelancers and freelance service-providing agencies for tasks such as web development and content writing

Visit the Akounto blog for more information and education about any accounting subject.