A lease is a contract that allows the lessee to use a property or an asset in exchange for monthly or annual payments. Two major types of leases in accounting are capital or finance leases and operating leases.

[ez-toc]

When it comes to differentiating between capital lease vs operating lease, IFRS does not recognize this classification. Both types are treated as a finance lease, and the lessees are entitled to record them on the balance sheet.

Under generally accepted accounting principles (GAAP), the major form of lease is the finance lease, also called the capital lease. All other types of rental leases fall under the operating lease.

This article discusses the differences between the two types of leases: capital and operating. We will also talk about the pros and cons of each so you can decide which will suit your business better.

Capital Lease vs. Operating Lease in Accounting

| Capital Lease | Operating Lease | |

| Ownership | Ownership of the asset transfers to the lessee. | Ownership of the property remains with the lessor during and after the lease period. |

| Bargain Purchase Option | Finance lease offers the bargain purchase option for the lessee to purchase the asset for a smaller price than its fair market value. | The operating lease does not contain a bargain purchase option. |

| Lease term | The lease period should exceed 75% of the estimated economic life of the asset. | The lease term is less than 75% of the estimated useful time of the property. |

| Present Value | The present value of the lease payments should be at least 90% of the total market price. | The present value of lease payments is less than 90 percent of the equipment’s fair market value |

| Risks and Rewards | Risks and rewards such as maintenance, insurance, and obsolescence are transferred to the lessee | Only the right to use the asset is transferred to the lessee. The remaining risks and benefits rest with the lessor. |

| Impact on the Income Statement | Depreciation of the asset and the interest expense on the future lease payments | The rental payments as the operation expenses are mentioned on the income statements. |

| Impact on the Balance Sheet | The present value or the fair value of the PPE (property, plant, equipment) is mentioned on the balance sheet. Assets increase as it is capitalized. | The lease payments are treated as expenses, so they are not listed on the balance sheet. |

| Risk of Obsolescence | The risk of obsolescence rests with the lessee as the ownership is transferred to the lessee when the lease term ends. | The risk of obsolescence is returned to the lessor at the end of the lease period. |

What is Capital Lease?

A capital lease also referred to as a finance lease, is a contract between the lessor and the lessee that grants the lessee the rights to use the asset but also transfers the ownership at the end of the lease period.

A capital lease is, in effect, the purchase of an asset and thus is recorded on the balance sheet. A capital lease is actually a debt instrument for the IRS, so the tax deductibles and the bank loan terms also apply. You can deduct interest payments on your income statement, but these deductions are very small compared to the rental expenses of an operating lease.

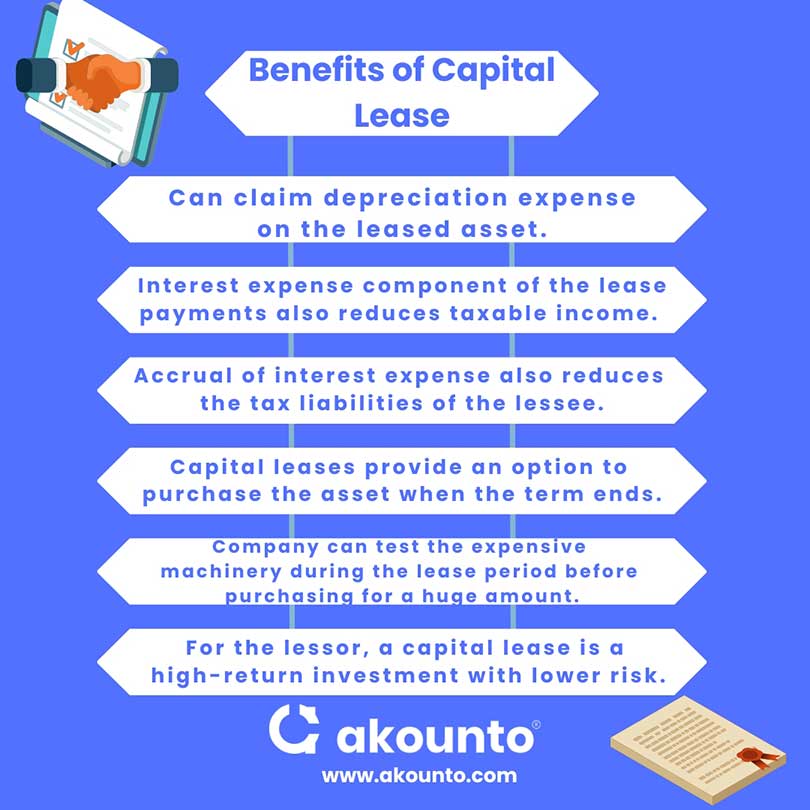

Pros

- Capital leases allow the lessee to claim depreciation expense on the leased asset. Depreciation calculations on the balance sheet impact the income calculations in such as way that the taxable income reduces. So, the business can save on its taxes.

- The interest expense component of the lease payments also reduces the taxable income. The accrual of interest expense also reduces the tax liabilities of the lessee.

- If the lessee decides to buy the asset at the end of the lease term, he can get it for a bargain price, much less than the market rate.

- Capital leases provide an option to purchase the asset when the term ends. This offers time for a company to test the expensive machinery during the lease period before purchasing for a huge amount.

- For the lessor, a capital lease is a high-return investment with lower risk than other forms of investment such as bonds and equity.

Cons

- Capital lease adds debt to the balance sheet of a business, which slowly repays in the form of lease payments. This increases the company’s debt-to-equity ratio, which is a bad sign for investors.

- The leased asset can become obsolete even before the lease period ends, especially if it is technology such as computers. But the company cannot undo the lease.

- The lessee acts as the owner of the leased asset for the lease period, which makes him liable for the maintenance and repair costs.

- Interest and depreciation expenses are tax-deductible, but they do not offer as much tax relief as the operating expenses with an operating lease do.

Examples of Capital Lease

A textile manufacturing company enters a capital lease agreement for leasing production machinery from another company. Its fair market value is US $100000, with an estimated economic life of 5 years. The lease payments of US $27,000 are scheduled for a lease life of 4 years at a 7% interest rate. The lessee receives the ownership of the asset at the end of the term.

Applying the generally accepted accounting principles (GAAP) and the guidelines listed by the IFRS, this lease type is a finance lease:

- The lease term covers at least 75% of the estimated economic life of the asset.

- The ownership of the asset transfers to the lessee when the lease life ends.

- The present value of the asset totals at least 90% of the asset’s fair value.

Heavy ticket assets such as aircraft, ships, diesel engines, and expensive commercial locations are available for purchase under capital lease. All these assets make fine examples of capital leases because companies are purchasing them on lease all the time.

What is an Operating Lease?

Operating leases are contracts between the lessor and lessee that grant the lessee the right to use the asset for a determined period. The ownership, however, remains wholly with the lessor.

The payments made toward an operating lease are recorded as operational expenses, not as asset ownership. So, they appear on the income statements instead of the balance sheet. Despite being an off-balance sheet financing, the new financial accounting standards Board (FASB) standard ASC 842 entitles all public and private entities to list their leases on the balance sheet.

An operating lease is a rental agreement, and the payments will also be recorded on the income statement as rental expenses. These payments do not count toward building an asset for the company, which is why they are treated as the regular expenses of a business. For the same reason, these payments act as tax deductibles.

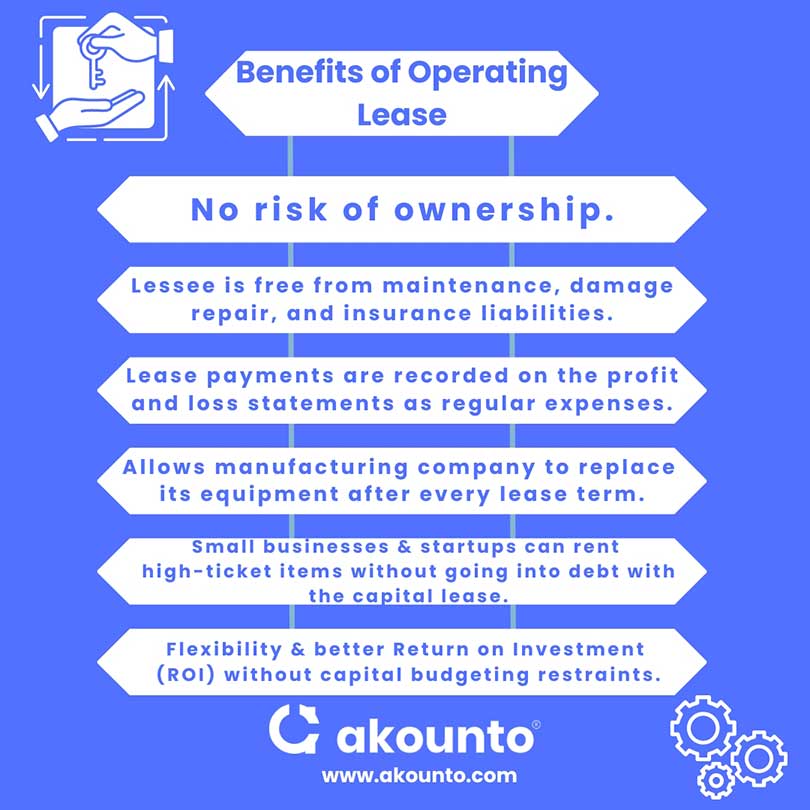

Pros

- There is no risk of ownership; hence, the lessee is free from maintenance, damage repair, and insurance liabilities.

- An operating lease lets small businesses and startups rent a high-ticket item or production machinery without going into debt with the capital lease. So, it provides flexibility and a better return on investment (ROI) without capital budgeting restraints.

- Operating lease payments are recorded on the profit and loss statements as regular expenses. They, therefore, reduce the taxable income of the business.

- An operating lease allows a manufacturing company to replace its equipment after every lease term.

Cons

- The leased asset will only be available for the fair market value when the lease ends despite paying the lease payments. The lease payments are hence only operational costs; they build no equity on the balance sheet.

- Long-term operating leases may sum up to be more expensive than the asset purchase or capital lease payments at the end of the lease term.

Examples of Operating Leases

Example 1:

A textile manufacturing company enters an operating lease agreement for leasing production machinery from another company. Its fair market value is US $100000, with an estimated economic life of 5 years. The lease payments of US $26,000 are scheduled for a lease life of 3.5 years at an interest rate of 7%. The ownership of the asset remains with the lessor during and after the lease period.

This lease type is an operating lease because:

- The lease term is less than 75% of the estimated economic life of the asset.

- The ownership of the asset does not transfer to the lessee.

- At 7%, the present value of the asset is less than 90% of the asset’s fair value.

Example 2:

A web design or content writing agency leases computer stations for two years. After every two years, they get updated equipment instead or choose to extend the lease for another two years.

Example 3:

Restaurants and cafes rent a busy location and pay the lease payments in return for using the premises. The rent is recorded as an operating expense in the profit and loss statements, reducing the taxable income.

This information about leases, their types, nature, and related rules can help businesses decide which type of leasing will suit their finances better.

Akounto is here to take up all your worries about the lease accounting, recordkeeping, and preparation and management of financial statements. Sign-up with Akounto today to outsource your sensitive accounting tasks to professionals and experts.