What is Financial Accounting?

Financial accounting consists of preparing financial statements to help stakeholders track financial performance at the end of the specified period.

Following are the stakeholders that are interested in the financial statements:

- Shareholders and owners

- Company’s Management

- Investors

- Analysts

- Government and tax authorities

- Compliance officers

[ez-toc]

Preparing financial statements or final accounts includes recording, summarizing, classifying, and reporting a company’s financial transactions.

Financial accounting aims to provide information that helps the stakeholders assess the company’s value and financial performance for a specified period.

The information provided is in the form of financial statements, i.e., final accounts, that include:

- Profit and Loss Statement, also known as Income Statement

- The Balance Sheet is also known as the Statement of Financial Position

- Cash flow statement

- Statement of retained earnings, also known as Statement of changes in equity

Basics of Financial Accounting

Financial accounting follows local and international accounting standards and guidelines for the preparation of final accounts of a company.

International Accounting Standards Board (IASB) has issued International Financial Reporting Standards (IFRS), laying down accounting standards for recording and reporting particular transactions.

The widespread adoption of IFRS among multinational entities has ensured consistency in financial reporting.

Generally Accepted Accounting Principles (GAAP) give accounting principles, standards, and frameworks applicable across jurisdictions for preparing financial statements.

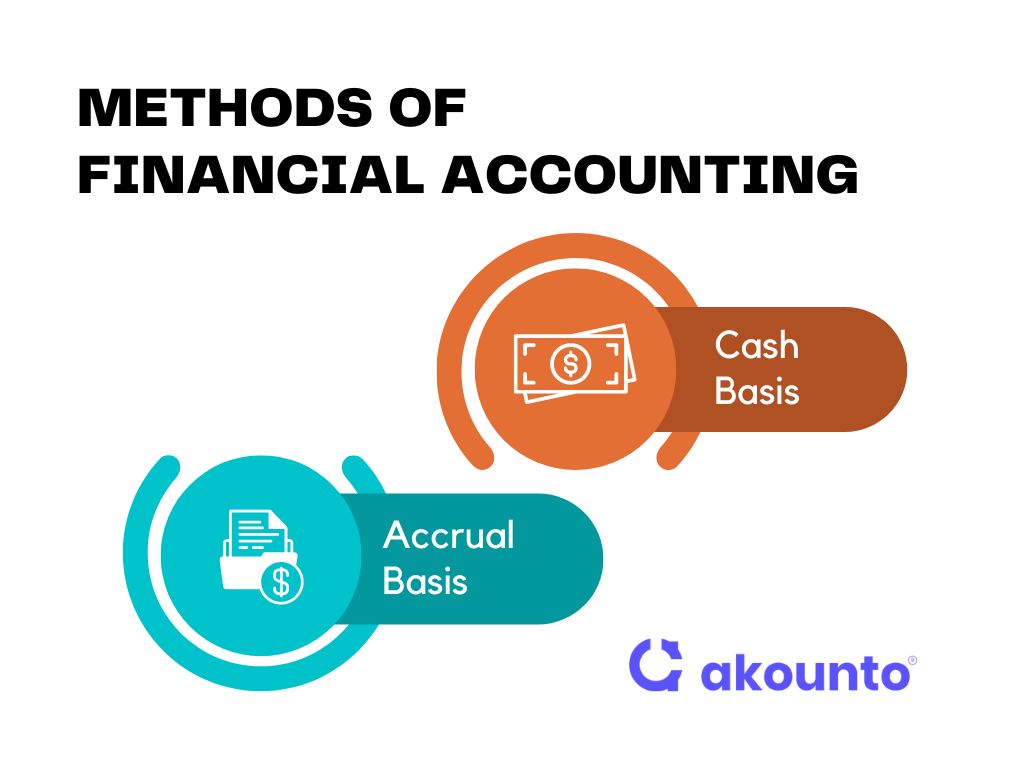

Two Methods of Financial Accounting

There are two accounting methods, from which one method is selected for recording and categorizing the transactions.

Cash or accrual is the basis of accounting, while double or single entry is the method of recording or bookkeeping. Let’s understand the methods of accounting:

Cash Basis

The cash-based accounting method considers transactions only when they affect the company’s cash in hand or the bank balance. In the case of expenses, when a certain amount is paid, such a transaction will be recorded.

The revenue is only recorded when cash is received, whereas an expense is recorded only when the cash is paid. Thus, a transaction is recorded only when the money is exchanged.

Accrual Basis

Accrual accounting considers income or expenses when they are incurred. It means it is recorded when there is an obligation to pay or receive the income. It does not wait for actually receiving in cash or bank.

The transactions are recorded as they happen and can be settled later. It helps record transactions for a period when they have occurred and conveys the true picture of the finances.

Double entry accounting is used for recording accounting information on an accrual basis.

Importance of Financial Accounting for a Business

Financial accounting helps organize and process financial transactions and data to make sense and convey the true and fair picture of business finances.

It helps evaluate the business performance and compare it with previous years to track the company’s growth.

Communication

External

Basic financial statements help various external entities to analyze a company’s financial statements and derive custom results.

Tax agencies are interested in the net income, while creditors are interested in the debt servicing capability of a company.

Analysts and investors are interested in growth patterns and rely on comparative analysis across different periods.

Internal

Financial accountants provide financial accounting data that forms the basis of managerial accounting. Internally, companies are interested in knowing the financial efficiency of business operations, working capital management, cash flow analysis, etc.

The business performance can be measured for a specified period or on a particular day. Balance sheets convey the financial health “on” a specific day, while income and cash flow statements represent financial information for a time period.

Financial Reports

Financial reports help interpret financial data and contribute to decision-making. It shows the profits or losses incurred for a specified period or a company’s financial health at a particular date.

A business owner can also compare two financial statements from two different periods. Thus, after comparison, one can get to know if the company is moving toward profitability or is falling towards loss.

Recording Transactions

A company must record all the transactions to track and measure its performance. Business transactions are complex and need updating to convey a true and fair picture.

A transaction affects more than one account, and there may be a need adjusting entries with the change in deals or contracts.

Recording transactions helps businesses be accountable and transparent and aids in decision-making. Documented trail of transactions helps in audits and evidence of business operations that are helpful in further analysis.

Compliance

Preparation of four basic financial statements could be a statutory requirement.

For example, the Securities and exchange commission requires companies to file Form 10-K and Form 10-Q for annual and quarterly reporting, respectively.

There are scaled disclosure requirements for “smaller reporting companies” and “emerging growth companies.”

Financial accounting helps you when filing tax returns when the fiscal year ends. Filing tax returns require financial statements. Also, financial accounting is a must for public companies making annual sales of more than 25 million. US GAAP (or GAAP) also recommends financial accounting principles.

Decision-Making

Financial accounting conveys a company’s liquidity via a Statement of cash flows, profitability via an income statement, and financial health of a company via a balance sheet. This helps the management to gauge the financial performance and make business decisions.

Financial accounting becomes the basis of managerial accounting and cost accounting.

Similarly, the analysis of financial statements impacts investors’ and shareholders’ investing and funding decisions.

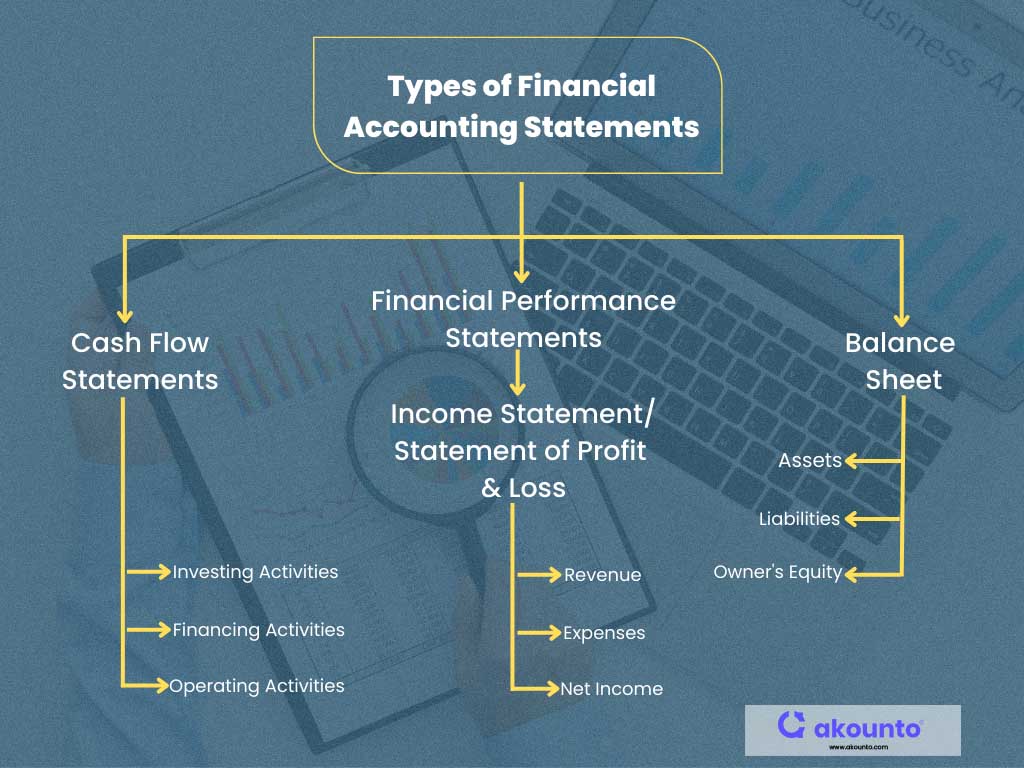

Types of Financial Accounting Statements

There are various financial statements when you start to do financial accounting. These statements are:

Cash Flow Statement

The cash flow statement comprises the following information:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities

A cash flow statement depicts the short-term liquidity of a company. It helps the company to know the inflow and outflow of cash and track the qualitative changes in the cash cycle.

Financial Performance Statement

The financial performance statement includes:

Income Statement

An income statement reports the net income earned by the company for a particular period. It includes operational and non-operational sources of revenues and set-off against all the expenses incurred during that period.

The profitability of any company or venture is known via the income statement. The operational sources of revenue include sales, fees, goods sold, etc. The revenue from non-operation sources includes revenues from royalties, rent, marketable securities, etc.

Similarly, operating expenses include salaries, cost of production, maintenance, etc. Non-operating expenses include write-offs, underwriting costs, depreciation, legal penalties, etc.

Profit & Loss (P&L) Statement

An income statement is also known as a Profit and Loss Statement or Statement of Profit and Loss. The owners and shareholders want to see the entity’s profitability to gauge the return on capital employed.

Similarly, investors are interested in the return on investments, while the tax agencies can assess the taxes on the profit.

Statement of Operations

The Statement of operations can also be deduced as a sub-set of an income statement. It tells the operating income of the company.

Statement of operations excludes the impact of non-operating revenues and expenses. Operating income denotes the efficiency of regular business operations. The primary expenses involved in generating the business income are taken into consideration.

Balance Sheet

A balance sheet is a summary and snap-shot of the business at any given time, i.e., the reporting date. The balance sheet is also called the “Statement of Position.” It reports the “book value” or the worth of the company.

The balance sheet shows assets, liabilities, and owner’s equity.

Assets

Assets include all the resources and properties owned or held inherent. Assets should be quantifiable and can also be obliged to receive, for example, debtors.

Assets consist of both current and non-current assets and tangible and intangible assets.

All assets in any form of cash (including bank accounts) or cash convertible within a year are known as current assets—for example, cash-in-hand, inventory, bank accounts, accounts receivable, marketable securities, etc.

Non-current or fixed assets are long-term assets that are not easily convertible to cash—for example, land, machinery, goodwill, equipment, trademarks, etc.

Liabilities

Liabilities include all the payments or debts, financial or legal obligations the company owes to pay, i.e., the liability. Similar to assets, liabilities are also categorized as current and non-current liabilities.

Current liabilities, i.e., short-term liabilities, includes accrued expenses, rent, payroll, maintenance, etc. They are meant to be paid within one financial year.

Non-current liabilities, i.e., long-term obligations, are meant not meant to be paid within a year—for example, bond payments, debenture payments, deferred tax liabilities, etc.

Shareholder’s Equity

Shareholders’ equity, also known as owners’ equity, is the total amount the company owner has invested in his company.

Shareholders’ equity includes the owners’ claim over the company’s assets after all the liabilities have been met.

Owners’ equity includes owners’ investment and earnings generated by the company and added to the owners’ share, i.e., retained earnings.

Statement of Changes in Equity

Statement of changes in equity measures the changes in the composition of a company’s owner’s equity. Such change is calculated over a specific period. It is also known as a statement of retained earnings.

Financial Accounting Standards

Financial accounting standards are the structure, guidelines, and frameworks for preparing financial accounts.

Financial Accounting Standard Board (FASB) maintains the structure and procedure. FASB is a non-profit organization that established financial reporting standards for public companies operating in the US. Also, FASB introduced Generally Accepted Accounting Principles (GAAP). GAAP provides accounting rules, policies, and bars. It has ten key points that show the laws and standards of accounting practices.

International Accounting Standards Board (IASB) was the organization that first gave the International Accounting Standards (IAS) to the world. IASB was based in London and was replaced by International Financial Reporting Standards (IFRS) in 2001.

GAAP often creates confusion with IFRS. IFRS is more of a principle-based standard and has worldwide acceptance.

Akounto, a cloud-based accounting system, helps small businesses and start-ups to maintain their accounts via financial accounting with adhering to accounting rules. Thus, this allows them to file taxes and make better decisions.