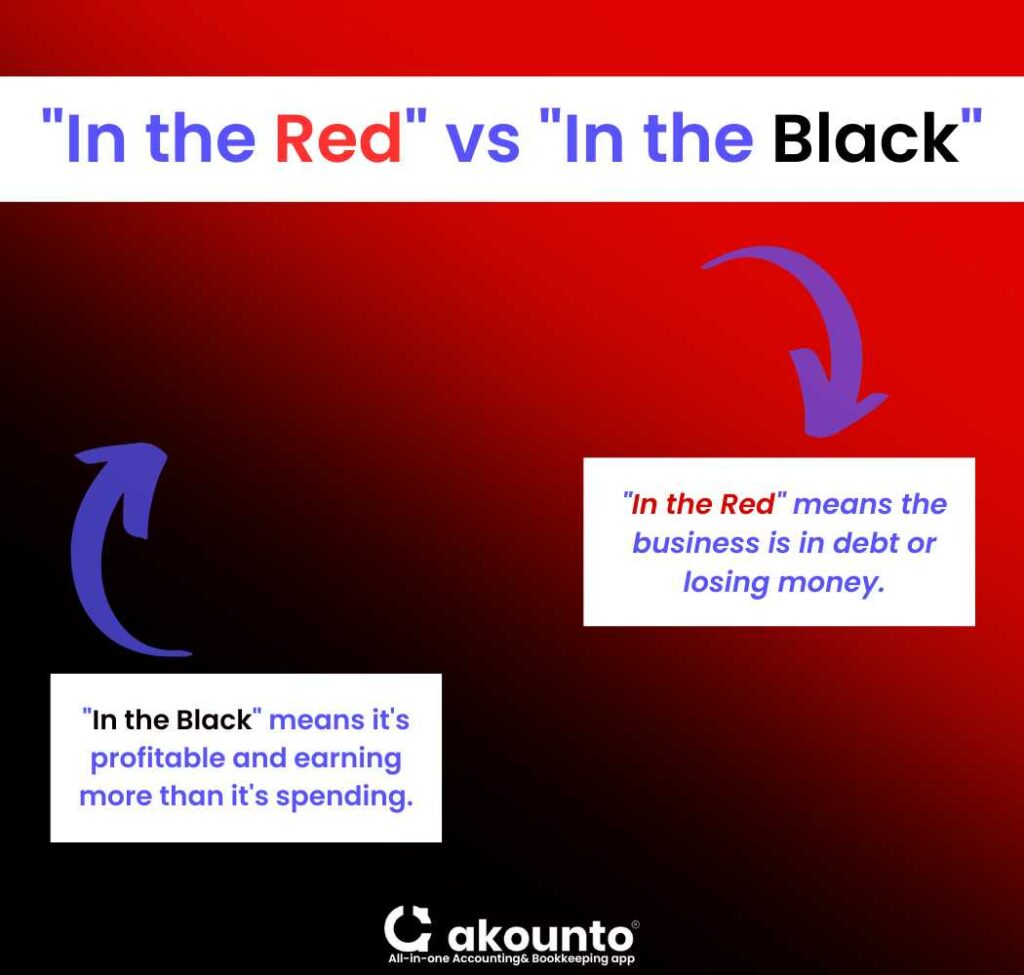

The phrase “In the red” indicates a business is in debt or losing money, while “In the black” describes that it is solvent and produces positive earnings after it has accounted for all expenses.

Black and red are two colors used to keep records and accounts since ancient times. In the past, accountants would use red ink to indicate a debit and black ink to indicate a credit. This system of using colors to indicate financial transactions is still used in some parts of the world today.

[ez-toc]

In modern times, black and red are also used to denote records or account transactions in computerized accounting systems. When it comes to in the black vs in the red, then the color-coding enables pictorial presentation of the financial outcomes that can be quickly glanced.

When making an entry into a computerized ledger, the color red usually signifies an outlay of funds, and the color black usually signifies an inflow of funds. It helps to make the accounts easier to read and understand.

In a color-coded financial statement, black signifies income, and red signifies expenses.

What Does the Phrase “In the Red” Really Mean?

The term “in the red” refers to a financial situation where a company or individual has more debt than assets.

Red companies operate at a deficit and spend more money than they earn. The red ink can be related to a negative balance in their bank account, meaning red companies owe more money than they have.

The phrase ‘in the red’ can also refer to a loss in an investment. For example, if you purchase stocks for $100 and their value decreases to $90, you are said to be “in the red” for the investment.

A company in the red signifies struggling with negative earnings and may not have enough money to perform well in the future.

What Does “In the Black” Mean?

The term “in the black” refers to a financial condition where a company or individual has more assets than debt and is financially solvent. The company operates at a profit and earns more than they spend.

A positive balance in their bank account indicates a solid business performance, and the company is making a profit. Black companies have more income than they owe.

In the black can also refer to a profit in secure investments. For example, if you purchase stocks for $100 and their value increases to $110, you are said to be “in the black” for the investment.

A company or investment in the black zone is performing well and may continue to do so in the future.

Difference Between In the Black and In the Red

The phrase “In the red” and “in the black” describe a business’s financial position.

Being “in the red” means a business is losing money and operating at a deficit with an uncertain future. It’s also regarded as harsh color like red ink.

Conversely, being “in the black” means that a business is profitable and has a good operational performance at a surplus. Its business practices cover the operating costs, and it’s able to generate profits.

One of the key indicators of a business’s financial health is its net income, which is the difference between total revenue and total expenses.

If the net income is negative, then the business is “in the red.” If the financial statements show enough revenue, then the business is “in the black.”

| In the Black | In the Red |

| Positive Cash flow | Negative Cash Flow |

| More money coming in than going out | More money |

| Financial Stability | Financial instability |

| Ability to Pay Debts | Difficulty in Paying Debts |

| Good Credit Score | Poor Credit Score |

| Profit-Making Business | Loss-Making Business |

| Investment Opportunities | Limited Investment Opportunities |

| Room for Growth and Expansion | Restrictions on Growth and Expansion |

| Attractive to Investors | Unattractive to Investors |

| Higher Confidence in Financial Management | Lower Confidence in Financial Management |

| Good Reputation in the Market | Poor Reputation in the Market |

Which is Better, In Black or In The Red?

It is better to be “in the black” than “in the red.”

Black companies operating at a surplus are more likely to cover operating costs and have a growing future. Its financial statements show lesser debt and higher assets. It is a positive connotation to investors and lenders as it demonstrates the business is financially stable and has positive earnings. It had more revenue generation and the capacity to repay its debts with interest rate.

But for most companies, it isn’t easy to maintain black color indicators consistently year after year. Black companies may even be ‘in the red’ for a brief period in case of sudden financial losses and more expenses.

For example, during the initial years, new businesses may incur high costs as they invest in new equipment, expand their workforce, and finance marketing and advertising.

In these cases, being “in the red” for a short period is acceptable, as the business is expected to become profitable over time.

Ways to move “Out of the Red” and “Into the Black”

Take Inventory of your Debt

When there is more debt than a business can handle, it’s important to take inventory of the debt.

Understand the types of debt inventory, the amount owed, and the applicable interest rates. The information can help prioritize your debt and develop a plan to get “out of the red” and into the black zone.

Re-analyze Your Budget and Spending

One of the first steps in getting a small business back on track is w to re-analyze the budget and spending. Look closely at the negative number and expenses and determine what can be cut or reduced.

It’s also important to consistently review the sales channels to see where revenue can be generated. It includes identifying new markets to sell products or services, expanding product offerings, or improving marketing strategies.

Rethink Client Payment Terms

Another way to improve finances is to rethink client payment terms. For red companies, you can raise funds by garnering generous client payments. But for black companies, consider tightening them up.

Requesting payment upfront or reducing the length of payment terms to avoid financial losses are a few ways to improve your cash flow and reduce the risk of not getting paid.

Boost Revenue

To improve the business’s financial position and increase its ability to generate revenue. It can be done by expanding the business’s customer base, improving the quality of products and service offerings, and increasing prices per market standards.

Raise Capital

If you need to raise funds to get the business back in the black remark, you can seek out investors, take out a loan, or use a line of credit.

Before taking on any new debt, make sure you have a clear plan about using the funds and repaying the loan with an interest rate to become financially solvent.

Improve Cash Flow

Good cash flow management is essential for a business to remain “in the black.” It ensures that cash is coming into the business faster than it is going out. Some ways to do that are by improving collections processes, reducing the amount of outstanding debt, and investing in financial management software.

How Accounting Software Can move Your Small Business “Into the Black”

Accounting software can be invaluable for small businesses that want to gain higher profitability and be “in the black.”

One of the key benefits of using an accounting system is that it automates many of the manual processes associated with managing a business’s finances. Most software includes tasks such as invoicing, payments, and bank reconciliation. By automating these tasks, accounting software can reduce the risk of errors and save time.

Another advantage of accounting software is that it provides real-time financial data. Business owners can see how much money is coming in and going out of their business at any time using the software.

Making sound business decisions involves data-backed decision-making in real-time, which is made possible by using accounting software.

Generating tax-compliant reports and documentation reduces the risks of penalties and fines. Keeping accounting records is also a statutory requirement that is often ignored by many small businesses; it is also helpful in claiming tax deductions.

Many different types of accounting software are available, ranging from simple spreadsheet-based programs to more complex enterprise resource planning (ERP) systems.

Final Words

When it comes to in the black vs in the red, then the businesses choose to stay in the black.

By automating your accounting processes, you can keep your business “in the black,” track expenses and revenue, and streamline your tax preparation and filing process. So, if you haven’t already, consider investing in accounting software for your small business today.

Join the revolution of modern accounting and start streamlining your business operations with Akounto today! Click here to learn more and sign up for a free trial now.