Retained earnings are not an asset but are classified as a liability. The company’s balance sheet shows retained earnings under the shareholders’ equity section.

[ez-toc]

Retained earnings cannot be classified as an asset. The retained earnings are the company’s profits, which were not issued as dividend payments to its shareholders but retained with the company.

Retained earnings are a kind of reserve money for the business, hence known as “earning surplus.” Retained earnings, when represented as a percentage of total earnings, is known as the “retention ratio.”

The shareholders have the final claim over the retained earnings, and any unused retained earnings must be returned. Therefore, this obligation makes retained earnings a liability, not an asset, and is represented under the stockholders’ equity section of the balance sheet. However, retained earnings can be used to purchase an asset.

Having retained earnings on the balance sheet provides a financial cushion and strategic advantage to a business owner.

Management of the company can invest retained earnings for the following purposes:

- Reinvest in the business

- Buy a competitor

- Add to valuation

- Purchase an asset

- Expand a product line

- Increase dividend payments in future

- Increase stock value

- Buyback of shares

- Funding research and development

- Paying debts

- Maintaining ROE during a downturn

- Financing working capital

Investors are interested in retained earnings as it signifies the company’s financial health and signals its ability to undertake expansion or handle sudden economic jolts without needing to take debt.

What are Retained Earnings?

Retained earnings represent the profits retained by the company, which were to be distributed to the shareholders. It denotes the surplus income that can foster business growth or meet contingencies.

The final retained earnings in the financial statements include previous retained earnings added to retained earnings of the reported financial year.

A business owner can choose to either pay dividends or retain the profits. The management of the company decides to hold back the dividend payments. However, shareholders can challenge management’s decision through a majority vote because shareholders are the real business owners.

The company management can pay a small dividend and retain the rest. Higher retained earnings on the balance sheet mean fewer dividend payments and impact the return on equity.

Tax on Accumulated Earnings

IRS imposes accumulated earning tax to discourage corporations from retaining earnings beyond the reasonable needs of the business.

As malpractice, many a time, businesses retain the earnings to avoid taxation on the shareholder. The liability of accumulated earnings tax depends on the following two factors:

- Accumulation of retained earnings is not justified by the corporation and is beyond the reasonable needs of the business.

- The corporation intends to evade taxes on the shareholders by accumulating the profits rather than distributing them as shareholder dividends.

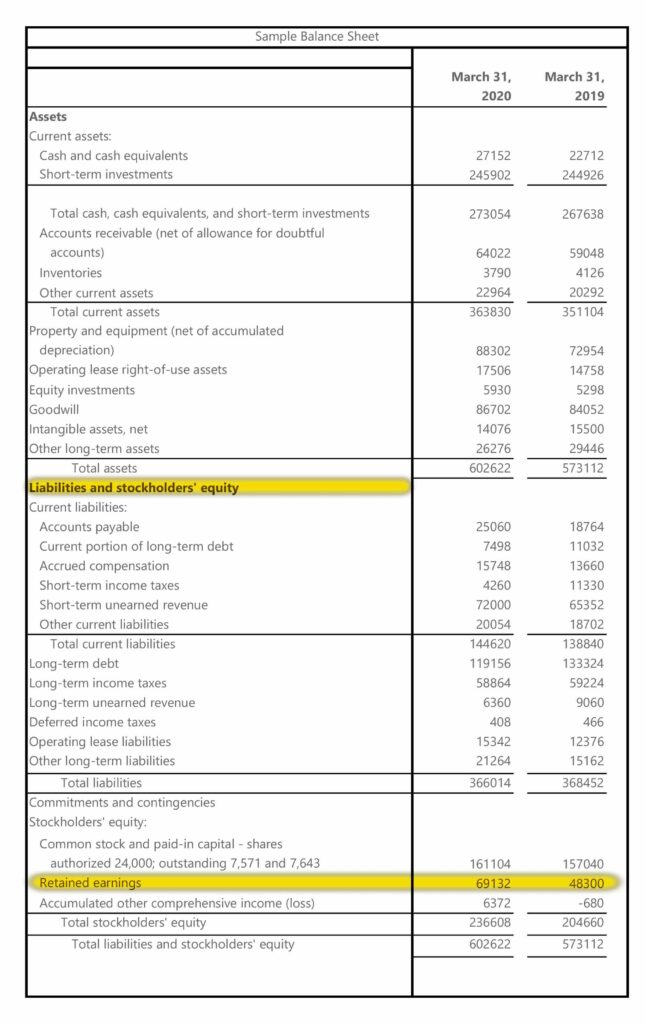

Retained Earnings on a Balance Sheet

In a company’s balance sheet, retained earnings account is shown under the Shareholder’s Equity section under the Liabilities classification.

In some balance sheets, the retained earnings are shown under the sub-section of “Reserves and Surplus” under the Shareholder’s Equity head.

Retained earnings being a liability, generally have a credit balance. However, a negative retained earnings balance can signal a net income loss in the previous accounting period.

On one side, the negative balance of retained earnings account represents a loss. In contrast, a higher amount of retained earnings signifies fewer dividends paid to the equity holders for the accounting period for which the company record retained earnings.

The company’s management needs to balance dividend distribution and retained earnings because investors and shareholders may have different views. A company that distributes fewer dividends can lose on market capitalization in the securities market and harm short-term investors.

How to Calculate Retained Earnings?

To calculate retained earnings, it is important to know three components of a business’s history;

- Previous retained earnings,

- Net income,

- And Paid Dividends.

A business’s previous retained earnings can be obtained from the balance sheet or statement of retained earnings. Net income can be found in the income or profit and loss statement. Paid dividends are payments a company makes to share profits with its stockholders.

If the business is new and has no previous retained earnings, enter $0 as retained earnings calculation. If the previous retained earnings are negative, label them accordingly.

Some factors that impact retained earnings include;

- Sales revenue: An increase or decrease in sales revenue directly impacts the growth of a business’s retained earnings.

- Operating expenses: are the overhead costs a company incurs to do business. These costs are related to inventory, rent, insurance, employees’ salaries, advertising and marketing expenses, and equipment. Lowering the operating costs can help the business accumulate more retained earnings.

- Cost of goods sold (COGS): is the sum of all direct costs associated with producing a product. If a business can lower the direct labor costs for production or find alternate materials sources can reduce the cost and increase the retained earnings.

- Depreciation: is the cost of a fixed asset spread throughout its lifecycle.

Higher retained earnings of a company indicate a stronger sign of its financial health and that it is generating enough revenue to cover all its expenses, pay out dividends, and has sufficient cash left over to invest back into itself.

Steps to prepare retained earnings statement

Step 1: Write the heading – Statement of Retained Earnings has a three-liner heading. The first line consists of the name of the company, the second line labels the document as “Statement of Retained Earnings,” and the third provides the year for which the statement is being prepared.

Step 2: Add items to the statement – These include the previous year’s retained earnings, net income from the business’s income statement, and dividends paid.

Step 3: Apply retained earnings formula – The computation of retained earnings figure at the end of the period can be shown by applying the formula:

Retained earnings = Retained earnings at the beginning + Net income/Net Loss – Dividends paid (Cash dividends or Stock dividends)

This completes the Statement of Retained Earnings.

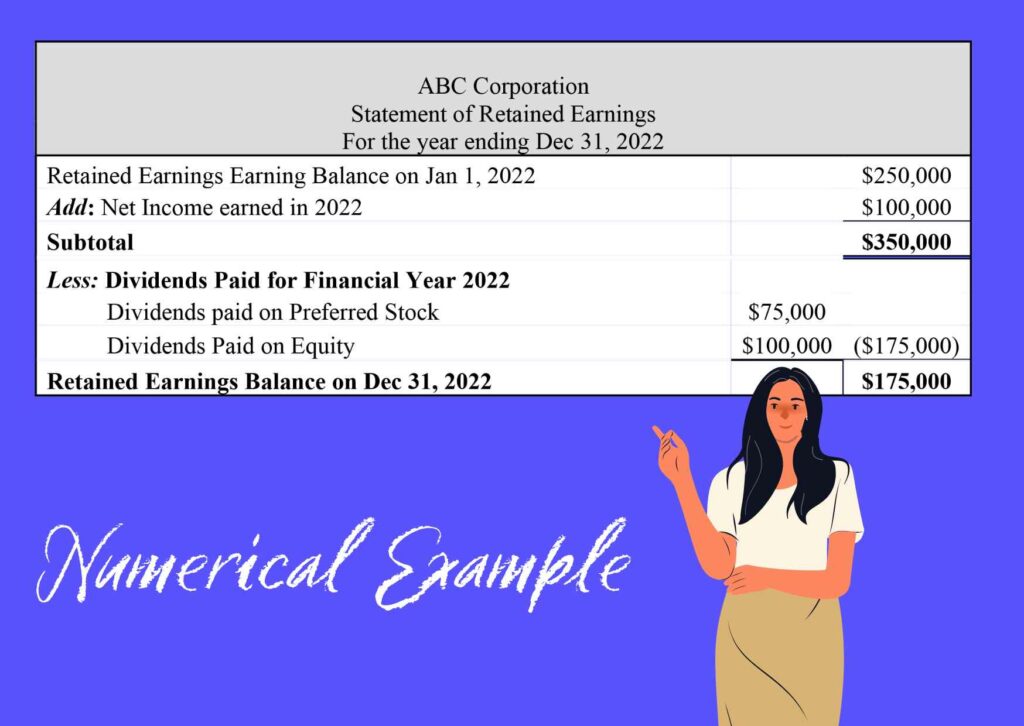

A numerical example of retained earnings

Let us look at the example question below for a better understanding.

Example: ABC Corporation’s retained earnings at the beginning of 2022 were $250,000. During the year, the company earned a net income of $100,000 after deducting all the expenses and paid a preference dividend of $75,000 and a $100,000 equity dividend to its shareholders. Calculate the retained earnings for the period ending in 2022.

Solution: Based on the information given, we have

- Beginning Retained Earnings = $250,000

- Net Income left = $100,000

- Dividends paid = $75,000 + $100,000 = $175,000

Prepare the Statement of Retained Earnings, then apply the retained earnings formula:

Retained earnings = Retained earnings at the beginning + Net income – Dividends paid

We get $250,000 + $100,000 – $175,000 = 175,000

$175,000 is retained earnings for the year ending Dec 31, 2022.

Wrapping up

Deciding how to invest net income is an essential task for small business owners, and retained earnings can tell you the total income available before making any major investment decisions, paying off debts, or improving enterprise valuation for funding.

Keeping your books straight is important regardless of how you use your retained earnings. In this article, we answered the basic question, “is retained earnings an asset?”, for more knowledge about accounting, visit Akounto blog.