What is Managerial Accounting?

Managerial accounting presents accounting information to assist managers in decision-making and policy formulation. It is also known as management accounting.

Informed decision-making is crucial for the success of any business. Day to day activities of a company generates a tremendous amount of financial data. This data must be recorded, processed, concise, and presented in a manner that becomes easily understandable while making managerial decisions.

[ez-toc]

Objectives of Managerial Accounting

Managerial decision-making revolves around planning, organizing, directing, and controlling the activities of a business. Let us get some insights into how managerial accounting helps managers in rendering some quintessential functions:

- Planning involves planning for budgets, forecasting, establishing performance metrics, setting goals, and charting a preliminary course of action to achieve the business goals. Trend analysis, estimations, etc., are the tools that are helpful for this stage.

- Organizing consists of defining the structure of the business or any process, defining KRAs (Key Result Areas), and developing the methodology for tracking and evaluating those KRAs, budgetary entitlements, etc.

- Directing can be understood as choreographing the actions of the people. It can be said as the “Ground-Zero” where the plans are implemented.

- Controlling encompasses the implementation of budgeting, cost controls, coordination, and tracking performance via KPIs (Key Performance Indicators). Some of the ways of “controlling” activities in finance include, but are not limited to, allocations, procedures, spending limits, cost-management, departmental controls, standard costing, inventory management, etc.

- Decision-making involves making an informed choice for a future course of action based on different alternatives available. It consists of the evaluation of those alternatives. The data-driven decision-making process is scientific, where there are defined methods and different techniques to process the data and reduce the scope of ambiguity. Capital budgeting decisions, cost-volume-profit analysis, segment costs, etc., are examples that pertain to decision-making processes.

- Simplifying complex financial data is essential to the process of decision-making. Analyzing large spreadsheets and numerable accounts can be tedious and resource-consuming. Management accounting presents data in charts, diagrams, graphs, etc. It utilizes some statistical tools to condense large amounts of data customized to the need and nature of the decision-making process.

The intended audience of management accounting is internal, i.e., the company’s management. Since it is for an internal audience, management accounting does not need to follow generally accepted accounting principles (GAAP) or any similar external accounting standards. Internal or managerial accountants can prepare managerial accounting reports without needing to engage certified public accountants.

Financial Accounting vs. Managerial Accounting

| Category | Managerial Accounting | Financial Accounting |

|---|---|---|

| End User | Internal Management | Internal and external users (stockholders, creditors, oversight agencies, government) |

| Statutory Position | Voluntary on the part of the company’s management | Compulsory filing of financial statements as per the prescribed law |

| Usage | Acts as decision support for higher management | Important for financial reporting and useful for external users |

| Level of Detail | Specific to certain decision points like inventory valuation, cost control, cost accounting, etc. | Overview of entire business operations |

| Report Frequency | Customised reports as per the needs of higher level management | Most companies have a statutory filing of Quarterly, half-yearly and annual reports. |

| Standards | Managerial reports are for internal use; following any particular industry standards is not necessary. Organizations might instead create their reporting guidelines independent of accounting standards to simulate business scenarios and predict trends. | Financial accountants typically adhere to the generally accepted accounting principles (GAAP) of the Financial Accounting Guidelines Board (FASB) and standards established by the International Financial Reporting Standards Foundation (IFRS). Financial accounting must adhere to accepted standards since it is used for external and internal purposes. |

| Nature of Report | Qualitative and Quantitative | Quantitative |

| Audit Requirements | No independent audits | Audited by Certified Public Accountant |

Types of Managerial Accounting

Decision-making is the center of all managerial activities. There are various ways by which managerial accounting assists in sound decision-making. Following are some of the methods and tools offered by managerial accounting that will help you to understand its uses and impact:

1. Capital Budgeting

Managerial accountants help business leaders evaluate projects and investments and make decisions about buying or selling assets. For this, capital budgeting employs techniques like net present value and internal rate of return to evaluate the viability of the projects or investments.

Projects and investments span years to decades and may have variable cash inflows. Capital budgeting helps evaluate complex projects by calculating discounted cash flow, payback periods, and other methods.

2. Margin Analysis

With increased production, the cost of production also rises. Managerial accounting analyses the net impact of increased production by calculating different metrics like contribution margin, break-even sales, sales cushion, etc. It helps in price discovery, i.e., a price point at which goods or services are sold and the product mix to ensure profitability.

With the increase in the cost of production, while the fixed cost remains the same, the variable cost, overhead costs, and other indirect costs increases. Marginal costing helps to measure the cost of goods sold and the optimum volume of sales that are needed to be maintained for sustainable operations.

3. Cash Flow Analysis

Managerial accountants conduct cash flow analysis to ensure the liquidity of a business concern. Working capital management is crucial for running the day-to-day operations of the business.

In layman’s terms, we can say that cash flows keep the business afloat. It includes both cash and cash equivalents. A healthy cash flow reflects an optimized operating cycle, efficient debt collection, and prudent financial management. Cash flows can be classified into the following three categories:

- Cash flows from operating activities: Regular operations like sales, purchases, credit recovery, etc.

- Cash flows from investing activities: Activities like sale/purchase of marketable securities, sale/purchase of assets, machinery, etc.

- Cash flows from financing activities: Activities like the infusion of capital, releasing dividend payments, withdrawal by owners, etc.

4. Constraint Analysis

Managerial accountants identify limitations or constraints on the capacity to generate profits or maintain cash flows for every product line. Constraint analysis identifies these principal bottlenecks and their impact on the bottom line. This risk assessment helps managers make better business decisions regarding product expansion, capital infusion, new product lines, etc.

5. Trend Analysis

Managerial decision-making involves accounting for future uncertainties and making predictions. Trend analysis is a statistical tool managerial accountants employ to bring predictability into decision-making.

With the use of historical data, the trends and patterns are tracked and predicted to ascertain probable outcomes in the future. Forecasting reduces the scope of ambiguity as the data points are tracked and mapped to identify logical consequences that can be an uptrend or downtrend.

The ability to account for uncontrolled variables and derive probable outcomes helps in effective decision-making and reduces the risks to some extent.

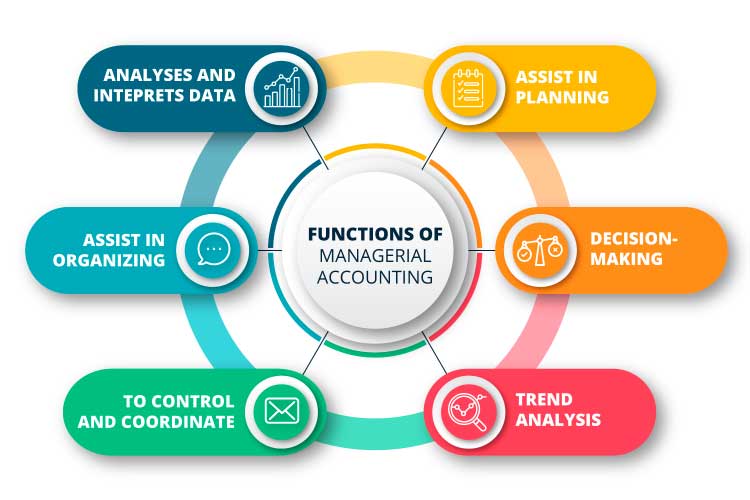

Functions of Managerial Accounting

Managerial accounting stems from the need for financial information to be presented to make decision-making easy. The financial reports like profit and loss statements, balance sheets, and cash flow statements are generated by statutory requirements. They are governed by strict accounting standards like US GAAP given by Financial Accounting Standards Board.

These are meant for external stakeholders. Although they form one of the inputs for managerial accounting, for internal management, managerial accounting utilizes a mix of departmental reports and other statistical tools to condense and present data for decision-making needs.

Following are some of the important functions that make managerial accounting an important facet of decision points in modern-day companies:

- To assist in formulating policies and strategies, managerial accounting provides reports like trend analysis, forecasting tools, scenario modeling methods, etc. They help in planning and strategizing. Historical data is often utilized to predict future patterns that help bring predictability in planning for future events.

- Managerial accounting makes the whole process of policy-making a scientific and data-driven. With the help of statistical tools and the application of specific knowledge, complex data is converted to simple data points, which give critical inputs for decision-making. There is a reduced scope of discretion.

- Simplifying and interpreting complex accounting data for business leaders is one of the main functions of managerial accounting. At the top-level management, strategic and long-term business decisions are taken. Complex relation amongst the data within spreadsheets is not evident unless it is processed with specific knowledge. Such ready information serves the decision-making process.

For example, you cannot derive the company’s liquidity position from its final accounts; for this, there are specific accounting ratios where a simple ratio depicts a precise picture that was not apparent in financial statements. - To generate customized reports. Final accounts are created as per the statutory requirements and accounting standards. They are intended for outside stakeholders. But for internal decision-making, the company’s management needs more reports than the final reports.

Like departmental budgets, cost sheets, performance evaluation reports, marginal costing reports, reorder quantity levels, etc. All these reports give deep insights into the specific areas in which the decision is to be taken. - To facilitate evaluation and coordination, managerial accounting provides numbers and levels that act as action triggers. Let us understand this by example.

If you increase production, your cost of production will also increase. Marginal costing reports will highlight the optimum volume to be produced and the price per unit to be charged to remain profitable.

Similarly, the ‘Reorder Level’ in stock management will get triggered when the stock limit falls to a predetermined level. It ensures that the supply chain is well fed and has minimum idle times.

Limitations of Managerial Accounting

1. Lack of Primary Data

There is very less data collection activity undertaken only for managerial accounting. Mostly it has to rely on secondary sources of data. Most of the time, the input data of managerial accounting is derived from the final accounts of the companies or other reports.

2. Personal Bias

The application of the managerial accounting process necessitates understanding several related topics. The firm will profit from managerial accounting if the managerial accountant is knowledgeable in relevant fields.

Management accounting is a tool that aids in decision-making. There can be different methodologies to process the same data set for a similar purpose. It solely depends on the end users’ intent on how they use and interpret the data.

3. Working Under Approximations

Creating a consistent policy is important while compiling management accounting reports. Management accounting data is gathered for decision-making, not for statutory reporting of financial status. Due to this, approximation of information is involved. It reduces the preciseness of the data. Also, when it comes to making estimates, the approximation is the only method that can be opted.

4. Need Specific Knowledge and Expertise

Management accounting is an interdisciplinary field. It links various subjects like accounts, finance, statistics, economics, management studies, etc. Due to this, there is a requirement for specific expertise. In addition, representation of data and report generation also needs skills that are more than simple accounting skills.

5. Fancy Sophistication

Management accounting is a very sophisticated branch of accounting and is expensive. There is a need to have trained individuals and deploy a network of standards across the organization. It is often viewed as a fanciful sophistication that only large organizations can afford.

Furthermore, it serves the interest of higher management in most of its use case scenarios. Therefore, it is not that popular despite being effective in small and medium organizations.

Final Words

Managerial accounting is an important tool in the decision-making arsenal of business leaders.

Preparing financial reports should not be limited to statutory requirements in a highly competitive business world. Rather it must be utilized to optimize business operations and make strategic decisions.

Often small companies get deprived of reports specific to certain activities, departments, or product lines.

In Akounto, you can see the breakup of your expenses and track your performance towards your projected profits right from its intuitive dashboard.