What is Public Accounting?

Public accounting refers to a firm or organization that offers accounting services and expertise to corporations, non-profit organizations, publicly held companies, governments, and individuals.

[ez-toc]

A public accounting firm (PAF) must hire certified public accountants and be GAAP compliant. That means a public accountant should hold a CPA license, and a bachelor’s degree in accounting is inevitable for CPA registration, if one wants to work in a public accounting firm.

Public accounting firms should also register with the Public Company Accounting Oversight Board (PCAOB) to provide accounting services.

Public accounting is quite different from a corporate accounting job. Public accountants work for accounting firms, where they get assigned all types of public accounting services, including auditing services, consulting activities, and assurance services. More importantly, they are expected to face clients.

Functions of Public Accounting

The functions and roles of a public accountant are multi-faceted, as they depend on the employing public accounting firm and the specific client’s needs. They can be a combination of the following:

- Preparing financial documents according to the Generally Accepted Accounting Principles (GAAP)

- Providing tax services such as filing tax returns, analyzing tax problems, estate, and planning

- Using their accounting expertise to offer consultation and advice on business matters such as mergers and acquisitions

- Auditing and reviewing the client’s financial statements for a target purpose, such as business loans or compliance with the SEC listing standards.

Accounting firms deal with multiple clients, unlike private accountants who associate with a single company. So, public accounting services will also include effective communication and management and not just working with financial statements.

Examples of Public Accounting

Prepare the Financial Statements for a Company on an Ongoing Basis

Public accountants prepare their clients’ financial statements and ensure they are accurate and in compliance with the laws and regulations before public exposure. For this task, an accounting firm may stay in touch with its clients on an ongoing basis, unlike most other one-time public accounting tasks.

Conduct Project-based Internal and External audits

Companies hire public accounting firms for internal and external audits because only a third party can conduct an authentic audit. Internal audits provide transparency and accuracy of the financial statements and help improve the company’s internal controls.

For external audits, certified public accountants prepare examination and investigation reports stating whether the reports of a company match its actual financial position or not. These third-party audits are admissible for bank loans and legal compliance authorities.

Prepare and File Tax Returns for an Individual or an Organization

Public Accounting firms prepare and file tax returns on behalf of their clients. This ensures that the taxes get filed on time and per the laws of the federal government, which get pretty complicated for private businesses. Large companies may have their accounting departments for this complicated task, while small businesses and individuals use the accounting expertise of these public accounting firms.

What is Private Accounting?

Private accounting, also called corporate or industrial accounting refers to accountants who serve one specific company or organization as part of its internal finance department. A single company employs private accountants instead of working for multiple clients.

The job duties of a private accountant include the following:

- Make journal entries for daily financial reporting.

- Plan budgets for the company’s business operations and payroll

- Evaluate the fiscal performance of the company over a certain period

- Prepare tax returns and ensure that the legal requirements sufficiently meet

- Assess internal controls, including risk assessment for the company

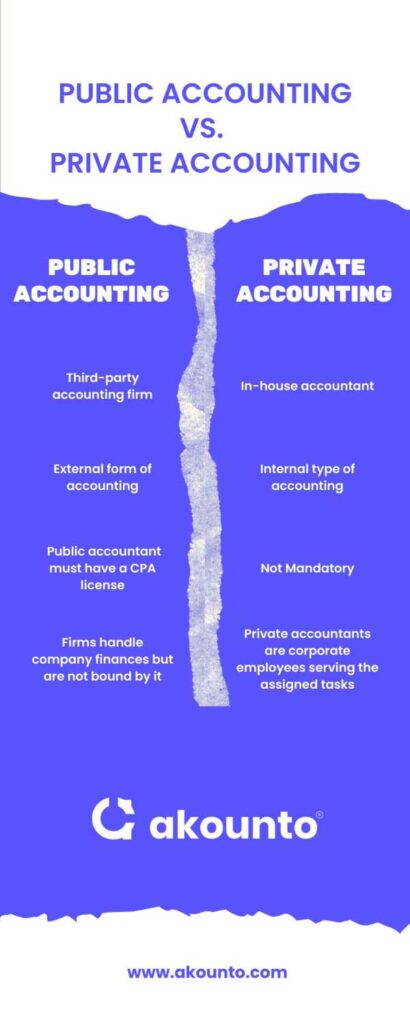

Public Accounting vs. Private Accounting

Following are the various areas in which we can see a clear difference between private and public forms of accounting in the real world:

- Public accounting refers to getting a third party, an accounting firm, for accounting functions. Private accounting, on the other hand, points to an in-house accountant or an accounting team handling your financial information, taxes, audits, etc.

- Public accounting is an external form of accounting, whereas private accounting is an internal type of accounting.

- A public accountant must have a CPA license. While some companies may prefer accountants with a master’s degree in accounting or a CPA license, these are not mandatory for the job.

- Public accounting firms may entirely handle the finances of a specific company on an ongoing basis but are not bound by it. Private accountants are corporate employees serving the assigned tasks or job description only.

Both public and private accounting can include management positions at some point in the career path. Good communication skills are essential for public and private accountants, but public accountants are expected to have strong organizational skills.

Sign up with Akounto today for expert accounting services for your business. Let our highly qualified specialists take care of your financial records, tax services, accounting activities, and everything surrounding them.